A Little Victory For The Remarkable Indian Coffee

Suman Das, 34, grew up in West Bengal’s Rasan village, drinking chai in mud cups with his younger brother Subham and their family of six, which included his parents. “Chai was our national drink,” he explains, smiling.

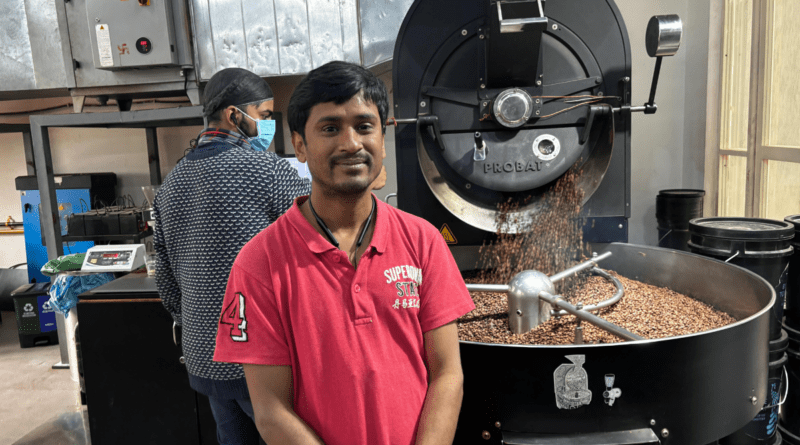

Suman now drinks 30–40 cups of coffee each day as a lead roaster at Blue Tokai, one of India’s fastest-growing and most successful specialty coffee companies. Sipping coffee and experimenting with different variations of what others might enjoy drinking is part of the job for a roaster. Das did errands at an advertising agency in Delhi before joining Blue Tokai over a decade ago.

Suman, who barely completed Class 10, is more than simply a lead roaster; he also sets up and operates all of Blue Tokai’s latest coffee-making machines. His brother Subham is currently one of the few “Q Graders” based in Bengaluru. The Das brothers are especially proud of the fact that they have converted their parents into regular coffee consumers. “I love machines and opening them up, learning new things,” Suman goes on to say.

Blue Tokai Coffee Roasters, co-founded in 2013 by Matt Chitharanjan and Namrata Asthana, is part of a new wave of specialty coffee firms in India, driven by economic prosperity. India’s per capita GDP increased by 7.9% to ₹2.12 lakh in 2024, nearly doubling from 2016.

HumbleBean, Maverick & Farmer Coffee Roasters, Nandan Coffee, KC Roasters, and Araku Coffee are among the enterprises driving a socio-cultural shift towards specialty coffee in India. There are various, frequently shifting estimates for the Indian coffee industry. According to Custom Market Insights, the Indian coffee business is predicted to generate $1 billion in revenue by 2032, up from around $500 million in 2023, rising at an average of 9%.

According to Statista, India’s coffee market is expected to earn $0.5 billion in revenue by 2024. This market is predicted to increase at a 9.22% annual rate between 2024 and 2028. In the same year, India’s per capita coffee revenue was expected to be $0.36. By 2028, the overall volume of coffee in the Indian market is predicted to reach 62.5 million kilogrammes, with a 5.3% volume increase in 2025 alone. In 2024, the average person in India will consume approximately 0.04 kilogrammes of coffee. This expansion is being driven by rising demand for specialty and artisanal coffees among Indian customers.

Aside from the rising income levels of India’s affluent middle class, a more health-conscious young population is gravitating towards coffee, particularly black.

As the Indian coffee environment grows, not only cafes but also coffee enthusiasts’ habits and preferences change. Pavitra Jayaraman, co-founder of Bengaluru-based mental health firm The PARC, wants convenience and quality while on the go. “When travelling, I take the Blue Tokai easy pour (Atikan Estate). “A pour-over in a travel pouch!” she exclaims.

However, her current choice is elsewhere. “My preferred beans to brew at home right now come from KC Roasters. I enjoy coffee with nutty and chocolate overtones. “I enjoy their Marvahulah and Kelagur Estate Coffee.” Pavitra’s choice represents a growing trend among Indian coffee drinkers: a desire to discover and appreciate a diverse range of beans and roasts from various roasters. “I think the big change for me with this new coffee explosion in India is that I used to ask relatives and friends to bring me coffee from their travels abroad; now, I send them my favourite ones instead,” she said.

Drinking coffee has always been regarded as ‘cool’ among India’s youth, long before the new-age specialty coffee firms emerged. For example, V. G. Siddhartha’s Cafe Coffee Day, with its motto “a lot can happen over coffee,” attracted a generation of young people growing up in the 2000s. Starbucks entered India in October 2012, but it took more than a decade to reach ₹ 1,000 crore in annual revenue.