Latest In The Most Recent Claim Settlement Ratio Of Life Insurance companies In India Was Released In 2024

The primary reason we purchase life insurance is to protect the future of our loved ones in the event of an unfortunate event.

So, before you invest your hard-earned money in an insurer, you should look into how they settle claims. This is where the claim settlement ratio comes into play. It is an important metric that provides an overall picture of how the insurance company handles policyholder claims.

What is the claim settlement ratio?

The claim settlement ratio is the percentage of claims paid out by the insurer compared to the number of outstanding claims during a fiscal year. As a general rule, the higher the claim settlement ratio, the more trustworthy the insurer is. So, if you’re looking to buy a new insurance policy or renew an existing one, you should consider the insurer’s claim settlement ratio as well as other factors like premium amount and coverage.

The IRDAI has released the most recent claim settlement ratio for life insurers.

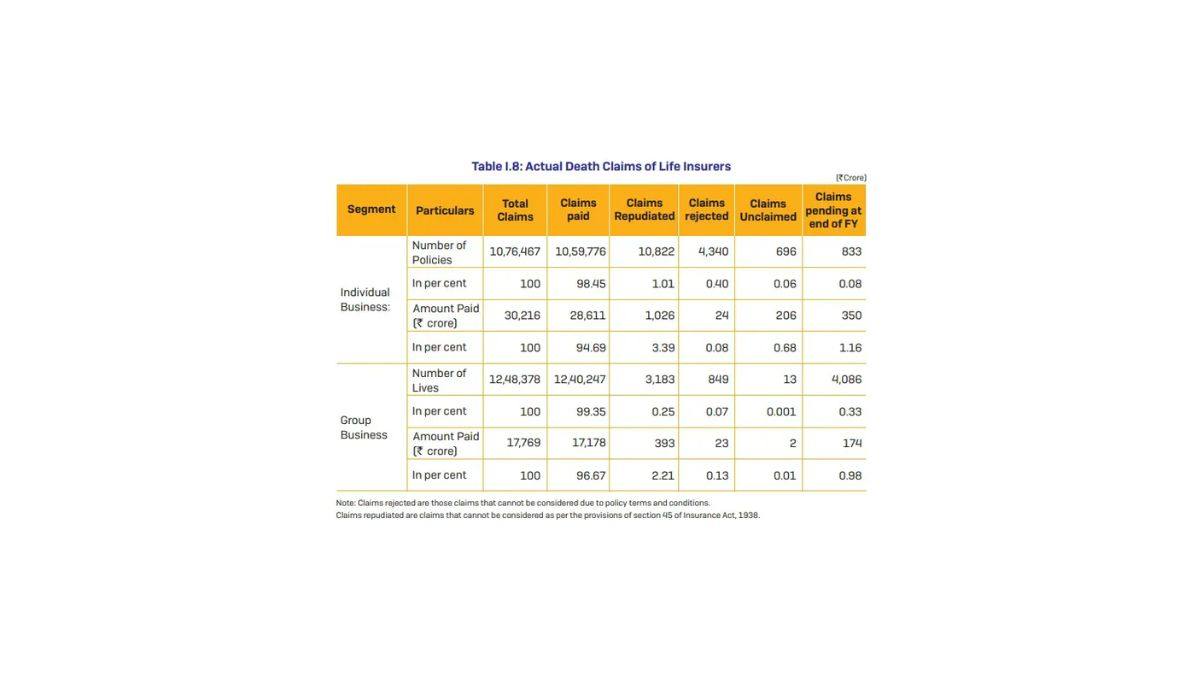

The Insurance Regulatory and Development Authority of India (IRDAI) recently released details of all life insurance companies’ claim settlements for 2022–23. The individual death claim settlement ratio for the life insurance industry was 98.45% in 2022–23. This means that the life insurance industry settled more than 98% of all individual death claim requests received in FY 2022–23. The overall claim settlement ratio was 98.64% in 2022–23.

What is the claim settlement ratio expressed numerically?

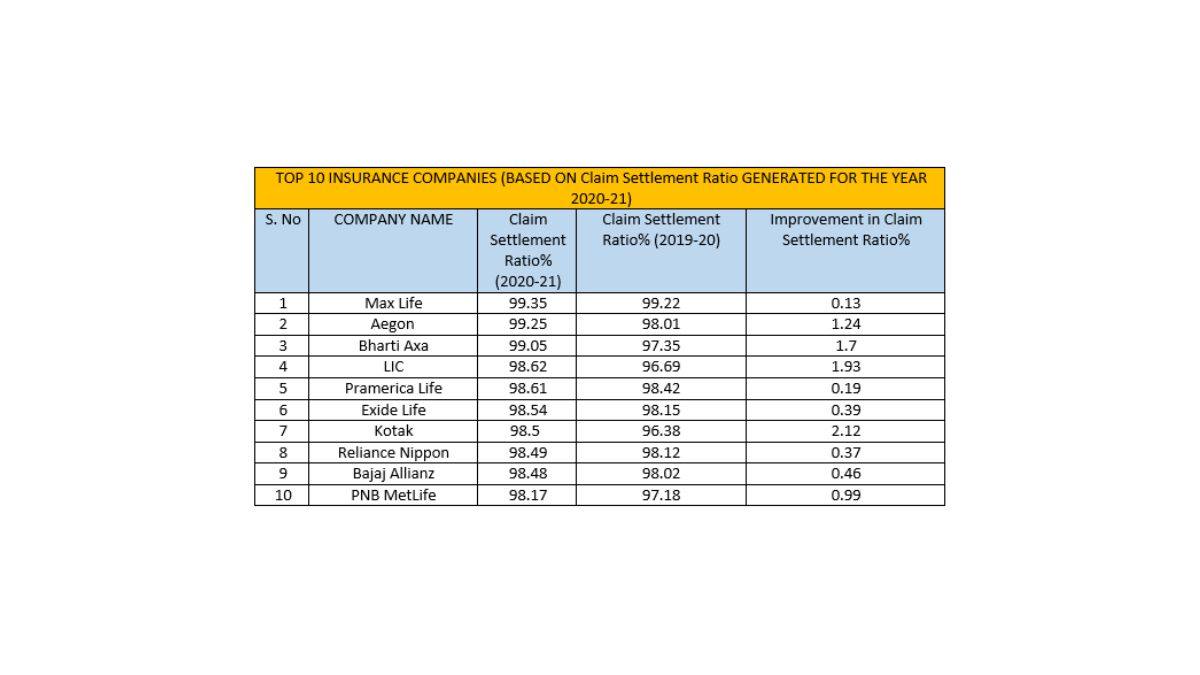

Max Life Insurance has the highest claim settlement ratio of 99.51% for policies settled in 2022–23. With a claim settlement ratio of 99.39%, HDFC Life Insurance ranked second on the list. Aegon Life Insurance ranked third with a claim settlement ratio of 99.37%.

LIC alone settled over 9.22 lakh claims in 2022–23. Meanwhile, the private insurance sector paid out 1.54 lakh claims during the same time period.

The claims repudiated ratio indicates how many claims the insurer determines to be invalid and thus does not pay the claimed amount. There could be numerous reasons why a life insurance company rejects a claim after accepting it for processing.

Nearly 100% demonstrates how efficient the insurance company is in settling claims. If a policyholder wants to know how easy it is to file a claim and how the insurer processes and pays those claims, a claim settlement ratio by number can be a helpful indicator.

Claims paid by amount: What policyholders should know

The claim-paid ratio by amount represents the percentage of the total value of claims submitted to an insurance company that are eventually paid out. A high ratio indicates that the company pays out a significant portion of the total value of claims submitted to it, whereas a low ratio indicates that the company denies or delays many claims.

Claim-paid ratios by number and by amount are used to assess an insurance company’s financial performance and ability to pay out claims to policyholders.

The claim settlement ratio of life insurance companies in 2024 (by amount)

Aegon Life Insurance had a claim settlement ratio of 99.37% when it came to the benefit amount paid out. Aviva Life Insurance had a claim settlement ratio of 98.74%, according to IRDAI data. Bharti Axa Life Insurance ranked third, with a claim settlement ratio of 98.09%. “The claims paid ratio by amount can be useful for policyholders who are more interested in the amount of money they might expect to receive if they file a claim,” said Sanjiv Bajaj, Jt. Chairman and MD, Bajaj Capital.