Spotlight: The Spirit Of The Global Economy And Its Challenge

The global economy is progressing, yet uncertain times persist. The global economy shows resilience amidst challenges.

August 1, 2023, WFY Bureau, USA: The world economy is on a steady path to recovery from the impact of the pandemic and geopolitical events like Russia’s invasion of Ukraine. Positive indicators are emerging in the short term, indicating progress.

The COVID-19 health crisis has officially subsided, and supply-chain disruptions have normalised. The first-quarter economic activity demonstrated resilience despite the challenging environment, with labour markets showing surprising strength. Energy and food prices have significantly decreased from their peak during the war, resulting in a faster-than-expected easing of global inflation. The decisive actions taken by US and Swiss authorities have helped contain financial instability following the March banking turmoil.

While these signs are encouraging, several challenges still loom ahead, warranting caution and vigilance.

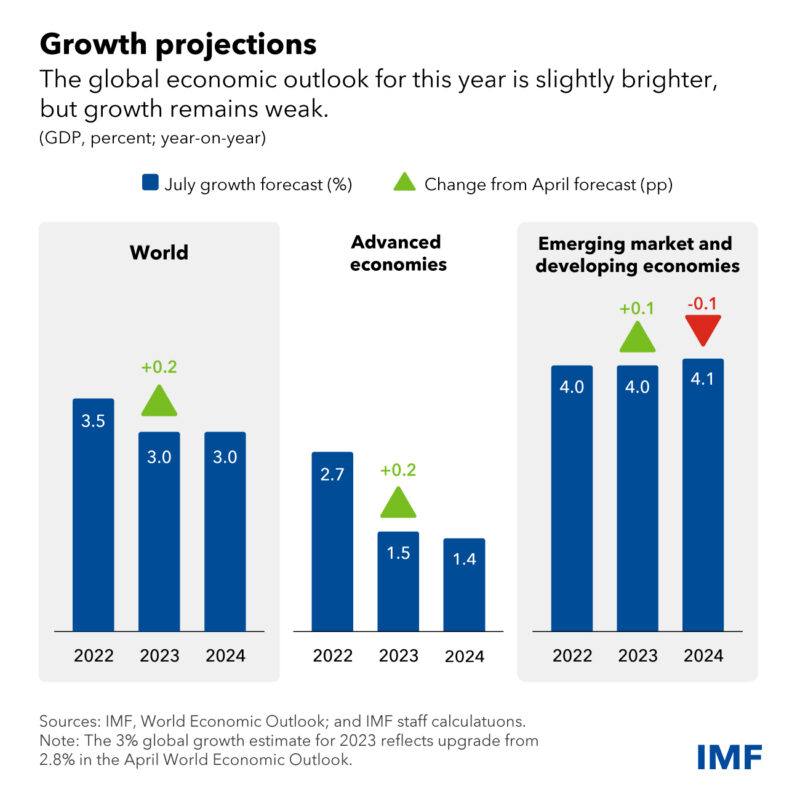

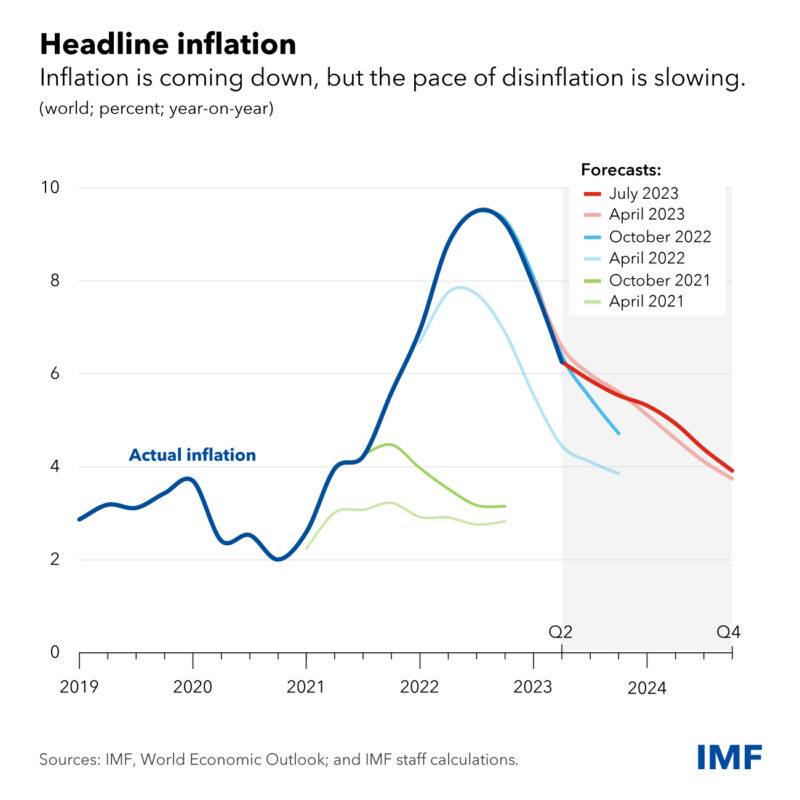

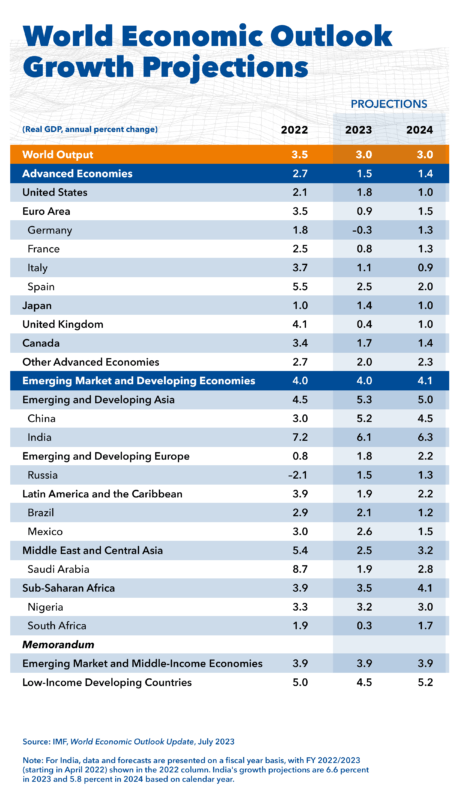

Global growth is projected to slow from 3.5 percent last year to 3 percent in the current year and the following year. This is a 0.2 percentage point upward revision for 2023 from our previous April projections. Inflation is also expected to decline from 8.7 percent last year to 6.8 percent this year, with a 0.2 percentage point downward revision, and further to 5.2 percent in 2024.

The slowdown is primarily affecting advanced economies, where growth is projected to fall from 2.7 percent in 2022 to 1.5 percent in the present year, remaining subdued at 1.4 percent in the following year. The euro area, particularly impacted by the surge in gas prices during the war, is expected to decelerate significantly.

In contrast, emerging markets and developing economies are anticipated to experience an uptick in growth, with year-on-year growth accelerating from 3.1 percent in 2022 to 4.1 percent in the current year and the subsequent year.

However, these overall figures mask considerable variations among countries, with emerging and developing Asia exhibiting strong growth at 5.3 percent in the present year. Conversely, many commodity producers are grappling with declining export revenues.

Despite the positive developments, certain risks persist, and the balance remains tilted towards the downside.

Firstly, there are indications of a loss of momentum in global economic activity. The global tightening of monetary policy has led to contractionary policy rates, affecting activity and credit growth in the non-financial sector. Households and businesses face increased interest payments, putting pressure on real estate markets. The extra savings from pandemic-related payments that earlier helped households weather the cost-of-living crisis and tighter credit conditions are being depleted in the United States. China’s economic recovery shows signs of weakening, raising concerns about the property sector with potential implications for the global economy.

Secondly, core inflation, excluding energy and food prices, remains above the central banks’ targets. It is projected to gradually decline from 6 percent this year to 4.7 percent in 2024, with a 0.4 percentage point upward revision. In advanced economies, core inflation is anticipated to remain unchanged at an annual average rate of 5.1 percent this year, falling to 3.1 percent in 2024. The fight against inflation has a long way to go.

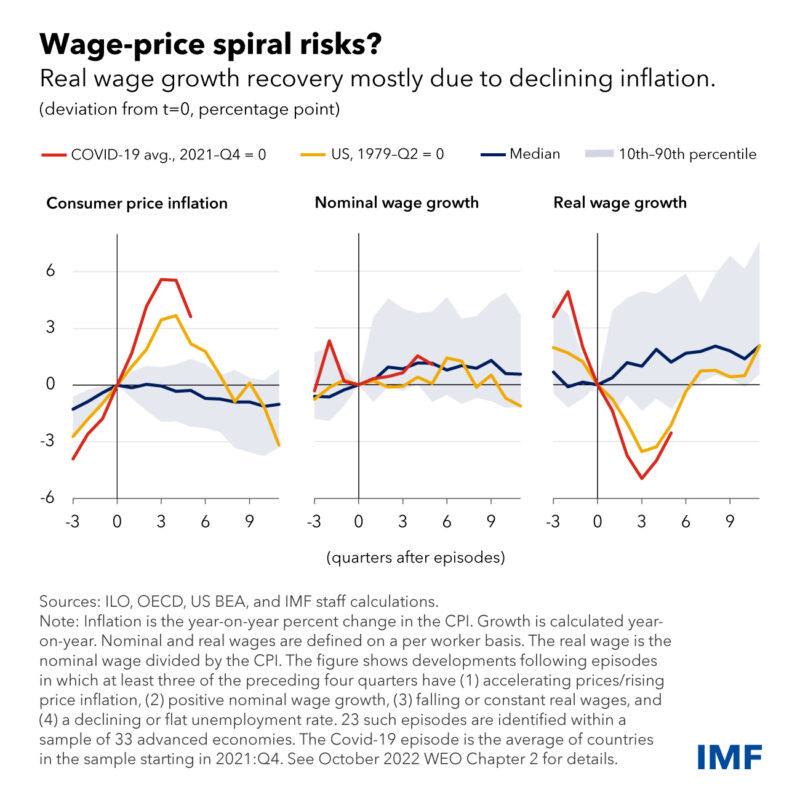

Labour market dynamics and wage-profit dynamics are crucial factors influencing inflation’s trajectory. While labour markets have shown strength, overall wage inflation lags behind price inflation in most countries. As a result, real wages have declined in advanced and large emerging market economies. Lower real wages contribute to reduced labour costs, which could explain the robustness of the labour market despite slowing growth. However, the increase in employment has surpassed the decline in labour costs, and the reasons for this phenomenon are not fully understood.

The future trajectory of inflation depends significantly on labour market developments. If labour markets remain robust, real wages may recover, contributing to strong nominal wage growth despite declining price inflation. Average firms’ robust profit margins over the past two years have supported the closing gap between real wages and price inflation, allowing for the accommodation of the rebound in real wages without triggering a wage-price spiral. Major economies’ well-anchored inflation expectations and slowing economic growth should also help contain the pass-through of labour costs to prices.

Nonetheless, labour market developments hold significant implications. If economic conditions deteriorate in the short term, firms may reduce employment sharply. Additionally, the strong recovery in employment coupled with modest increases in output suggests a decline in labour productivity, which could negatively impact medium-term growth.

Financial conditions have eased since the March banking crisis, despite monetary policy tightening and a slowdown in bank lending. Equity market valuations, particularly in the artificial intelligence segment of the tech sector, have surged. The depreciation of the dollar has been driven by expectations of a more accommodative path for US interest rates and improved risk appetite, providing relief to emerging and developing countries. However, there remains a risk of sharp repricing should inflation surprise on the upside or global risk appetite deteriorate, leading to a flight towards dollar-safe assets, higher borrowing costs, and increased debt distress.

Policy-wise, when inflation starts to decline, we go into the last phase of the inflationary cycle that began in 2021. While prospects for the global economy are more balanced, major economies are less likely to require additional outsized increases in policy rates. Some Latin American economies have already seen policy rates peak. However, premature easing of rates must be avoided until underlying inflation shows clear and sustained signs of cooling. Central banks should continue monitoring the financial system and be ready to use other tools to maintain financial stability.

With fiscal support provided in numerous countries over the years, it is time to gradually rebuild fiscal buffers and ensure more sustainable debt dynamics. This will safeguard financial stability and enhance the credibility of disinflation strategies. Fiscal consolidation should be mindful of private demand strength and protect the most vulnerable without resorting to generalised austerity. For instance, with energy prices returning to pre-pandemic levels, it is appropriate to phase out certain fiscal measures, such as energy subsidies.

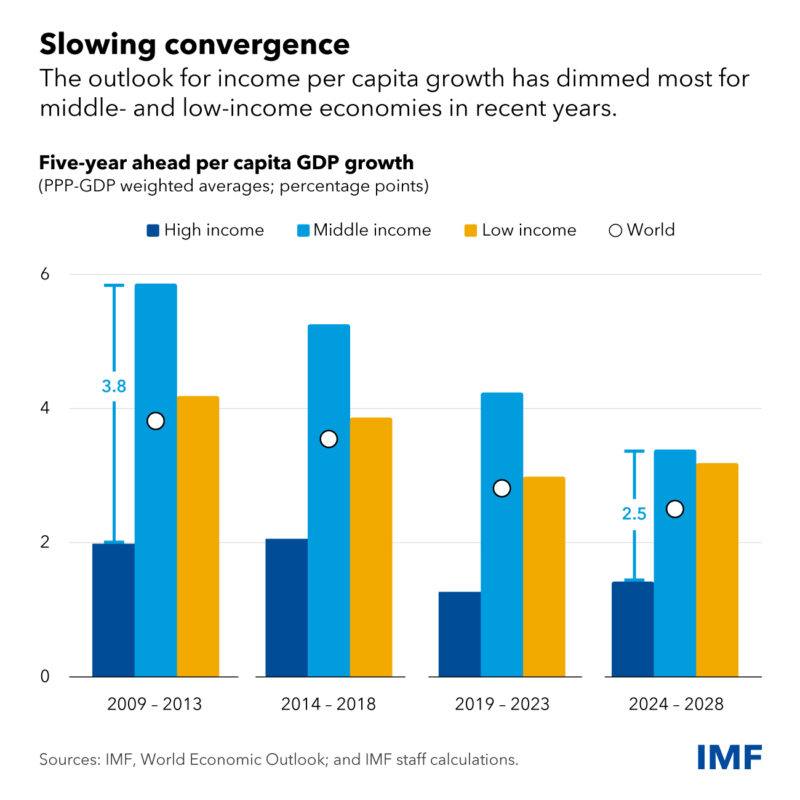

Fiscal space is also essential for implementing much-needed structural reforms, especially in emerging and developing economies. These reforms are critical as the prospects for medium-term growth in income per capita have diminished over the past decade. Low- and middle-income economies, in particular, face a sharper slowdown compared to high-income ones, impacting their ability to catch up with higher living standards. However, elevated debt levels are hindering many low-income and frontier economies from making necessary investments for faster growth, raising the risk of debt distress in various regions. While the progress towards debt resolution for Zambia is encouraging, other highly indebted countries require faster action.

Some regions’ slower growth is due to the negative policy ripple effects. Geoeconomic fragmentation is resulting in the global economy splitting into rival blocs, which disproportionately affects emerging and developing economies dependent on an integrated global economy, direct investment, and technology transfers. Additionally, insufficient progress in the climate transition exposes poorer countries to severe climate shocks and rising temperatures, despite their minimal contribution to global emissions. Multilateral collaboration is still essential in addressing these issues in order to guarantee a secure and thriving economy for everybody.

In conclusion, the global economy shows promising signs of resilience in the near term despite lingering challenges. The pandemic’s grip has loosened, and supply chains are getting back on track. While advanced economies face a slowdown, emerging markets and developing economies are expected to fare better. Nonetheless, risks persist, such as the loss of momentum in economic activity, the battle against inflation, and potential financial repricing. Policymakers need to strike a delicate balance between managing monetary and fiscal policies while also fostering structural reforms to enhance growth prospects and tackle issues like debt distress and climate transition. Only through continued cooperation and prudent policy measures can the global economy navigate its way out of the woods and towards sustained prosperity.

References: WEO Update July 2023 Press Briefing Transcript

https://www.imf.org/en/News/Articles/2023/07/25/tr072523-transcript-of-world-economic-outlook-update

Woah! I’m really digging the template/theme of this site. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between user friendliness and visual appearance. I must say you have done a excellent job with this. Additionally, the blog loads super fast for me on Firefox. Outstanding Blog!

Wonderful website. A lot of useful info here. I’m sending it to a few friends ans also sharing in delicious. And obviously, thanks for your effort!