This Is The Great Shift: Rewriting Asian Entertainment World

The Great Shift: How Streaming Is Rewriting Asia’s Entertainment Economy

A new hierarchy of screens

Across Asia’s vibrant entertainment landscape, a quiet but decisive transformation is underway. Television, the long-time monarch of living-room storytelling, is surrendering its throne. In its place, streaming platforms, once dismissed as upstarts, are redefining what audiences watch, how content is financed, and where creative value now resides.

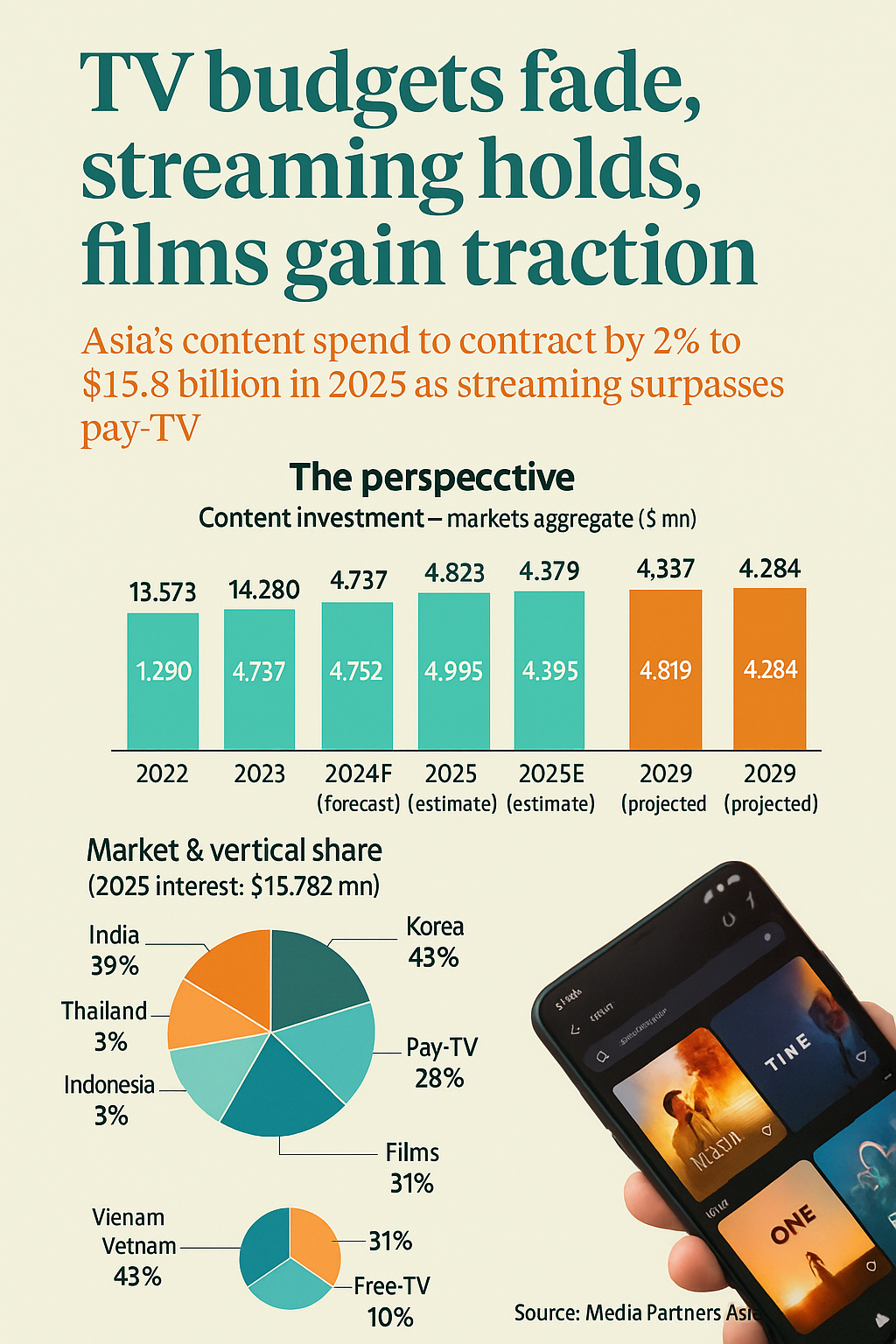

According to a comprehensive study by Media Partners Asia, content investment across seven major Asian markets, India, South Korea, Indonesia, Malaysia, Thailand, the Philippines and Vietnam, will fall slightly by 2 percent to $15.8 billion in 2025. The number may appear stable, but its composition tells a larger story. For the first time, online video will overtake pay-TV in total investment, confirming that the region’s centre of gravity has permanently shifted from cable boxes to connected screens.

Where the money is going

The breakdown of this $15.8 billion paints a fascinating picture of regional priorities:

- Films: $4.98 billion (around 31 percent of total spend)

- Online Video: $4.82 billion (32 percent share)

- Pay-TV: $4.37 billion (31 percent share)

- Free-to-air broadcasting: about $1.6 billion (10 percent share)

By 2029, overall spending is forecast to rise again to about $16.7 billion, but the pattern will remain: streaming and film will drive the growth, while traditional television continues its gradual contraction.

The reasons are structural. Advertising revenues for television are eroding as brands follow younger consumers onto digital platforms. Subscription models for satellite and cable services are stagnating. Meanwhile, streaming companies, despite tightening their budgets, still command unmatched consumer attention, allowing them to negotiate more profitable partnerships with studios and telecom operators.

India and South Korea: twin engines of Asia’s content economy

The regional hierarchy is strikingly clear. South Korea remains the largest single investor in content creation, with an expected 43 percent share of the total Asian budget in 2025. India follows closely with 39 percent, making these two countries responsible for more than four-fifths of Asia’s entire entertainment outlay.

In India, the explosion of mobile data access and affordable broadband has made streaming not just an urban phenomenon but a pan-Indian habit. Platforms such as Jio Cinema, Disney+ Hotstar, Netflix India, Amazon Prime Video, and ZEE5 now compete for both eyeballs and advertising rupees. In the second quarter of 2025, India alone generated 21.5 billion hours of video-on-demand viewing, the highest in the world outside China.

South Korea, for its part, has turned global cultural influence into economic power. K-dramas, variety shows, and music-driven programming continue to dominate pan-Asian exports. The country’s production ecosystem, backed by private investment, government support, and creative risk-taking, has set a benchmark for how content can travel beyond language barriers while remaining rooted in local sensibilities.

Why TV is losing ground

Television’s decline in these markets is neither sudden nor accidental. A confluence of technological and demographic forces has chipped away at its dominance.

First, younger audiences no longer follow fixed broadcast schedules. They expect control: when to watch, where to pause, and how to skip adverts. This behavioural change undermines the economics of pay-TV, which depends on bundled channels and long-term contracts.

Second, production costs for television have not fallen in tandem with its shrinking reach. Networks still face the same expenses for sets, crews, and transmission rights, but with less advertising income to sustain them. Even marquee channels are trimming prime-time budgets or moving flagship shows to their digital arms.

Finally, data analytics has empowered streaming platforms to micro-target viewers in a way television cannot. For advertisers, measurable engagement is worth more than raw viewership figures. For producers, the ability to track audience preferences in real time helps shape future storytelling.

The result is a self-reinforcing cycle: as streaming grows smarter, television becomes less competitive.

The resurgence of film investment

Amid the turbulence, one medium is enjoying an unexpected revival, cinema. After the pandemic slump, film production budgets are climbing again across Asia, particularly in India, Korea, and Indonesia.

There are several reasons. Theatres have rebounded strongly since 2023, driven by event releases and improved screen infrastructure. Audiences now see the cinema outing as a social experience distinct from home viewing. Producers are responding by creating larger-than-life spectacles designed specifically for theatrical release before moving to streaming.

Moreover, streaming platforms themselves have become major financiers of film projects. Exclusive premieres or limited theatrical runs help platforms attract new subscribers while giving filmmakers creative freedom outside the constraints of television formats. In India, nearly one-third of films released in 2025 are expected to have some form of digital co-production or distribution deal.

Films are once again the cultural flag-bearers of national identity, and, increasingly, of cross-border collaboration.

The streaming paradox: growth under pressure

While streaming commands the spotlight, its internal economics remain precarious. The race for subscribers has slowed, prompting platforms to pursue profitability rather than pure expansion. Many are cutting back on expensive original series and investing instead in regional remakes, shorter formats, or dubbed versions that stretch budgets further.

A typical high-quality drama episode in India now costs around ₹70 lakh–₹1 crore to produce, while comparable shows in Korea or Japan can exceed $500,000 per episode. To justify such costs, platforms need either massive global audiences or strong advertiser backing.

Hence, advertising-supported streaming (AVoD) is on the rise. In India, nearly 60 percent of all streaming viewership now happens on ad-based tiers rather than paid subscriptions. Telecom bundles further blur the line between free and paid access.

Streaming’s challenge is therefore twofold: keep quality high while managing costs in an environment where consumer willingness to pay is limited.

The economics of attention

In Asia’s competitive attention economy, time spent has become the ultimate currency. A recent measurement of on-demand viewership in 2025 found that JioStar India and CJ ENM Korea together account for more than half of all streaming hours in the region. Global giants such as Netflix, Amazon MGM Studios, and Disney Hotstar still dominate in brand recall, but regional players have captured the daily engagement cycle.

What distinguishes these local services is their grasp of cultural rhythm, language, music, humour, and festivals. In India, regional-language originals in Tamil, Telugu, and Bengali now constitute over 40 percent of domestic digital premieres. In Korea, the expansion of web-dramas and variety content for mobile viewing has tripled the number of low-budget yet high-return productions.

For advertisers and investors, this fragmentation means opportunity. For creators, it means relentless pressure to innovate without inflating costs.

What the data reveals

The aggregate figures from the 2022–2029 period highlight three major shifts:

| Year | Total Content Investment ($ million) | Online Video | Pay-TV | Films | Free-to-Air |

| 2022 | 13,573 | 4,772 | 3,872 | 3,641 | 1,290 |

| 2023 | 14,780 | 4,737 | 4,152 | 4,413 | 1,478 |

| 2024 | 16,087 | 5,103 | 4,595 | 4,894 | 1,496 |

| 2025 (forecast) | 15,782 | 4,819 | 4,379 | 4,979 | 1,606 |

| 2029 (projection) | 16,745 | 6,403 | 4,198 | 4,284 | 1,860 |

The numbers reveal a brief contraction in 2025, largely due to reduced television spending, followed by renewed expansion led by digital and film. Over the entire period, online video investment grows by more than 34 percent, while pay-TV declines by 9 percent.

The Indian diaspora angle

For the global Indian community, this shift carries special significance. The diaspora has long relied on satellite television and imported DVDs to stay connected with the culture of home. That dependency is now obsolete.

Streaming services have democratised access to Indian content worldwide. From Birmingham to Boston, Singapore to Sydney, Indian audiences can watch local web series the same day as viewers in Mumbai. The result is a more unified yet diversified global cultural footprint.

Indian production houses are increasingly tailoring projects for international Indians, mixing English and Hindi dialogue, setting stories in migrant communities, and exploring hybrid identities. This not only strengthens cultural continuity but also enhances India’s soft power abroad.

Diaspora consumption patterns are influencing budgets back home too. Series that trend in overseas markets attract higher advertising rates and sponsorship deals. As India’s OTT exports rise, so does the credibility of its entertainment sector as a global industry rather than a purely domestic one.

Regional contrasts and common challenges

Although the overall Asian market is moving in the same direction, the pace varies by country.

- Vietnam and Malaysia together account for just 5 percent of the region’s content investment but show the fastest digital growth rates, over 20 percent annually, thanks to low-cost local streaming services.

- Thailand and Indonesia maintain moderate growth, balancing free-to-air content with rising OTT demand.

- The Philippines, while small in share, is witnessing a surge in mobile-first video consumption; over 90 percent of viewing now happens on smartphones.

Across all markets, however, the headwinds are similar: rising production costs, advertising slowdown, and audience fatigue from too many subscriptions.

Profitability: the new frontier

For a decade, streaming companies chased scale. Now they are chasing profit. Analysts project that by 2027, Asia’s top ten OTT services will collectively achieve positive operating margins for the first time.

The playbook is shifting from “grow at any cost” to “sustain with efficiency.” Bundling, partnerships with telecom operators, and regional co-productions are the levers being pulled. In India, Reliance Industries’ integration of content, connectivity, and commerce provides a model for others, offering users a single ecosystem that merges entertainment with lifestyle.

Korean studios are forming similar alliances with global partners, exporting finished shows rather than licensing rights piecemeal. This strategy maximises revenues while retaining creative control.

The role of artificial intelligence in production

Technology is quietly transforming how content is made. AI-assisted editing, dubbing, and script analysis are reducing turnaround times and costs. In multilingual markets such as India and Southeast Asia, automated translation and lip-sync tools enable simultaneous releases across languages, expanding reach without multiplying budgets.

Virtual production, using LED walls instead of outdoor locations, is also taking hold. For mid-budget series, it can reduce expenses by up to 25 percent. Korean studios are leading in adopting these techniques, while Indian producers are fast catching up through shared infrastructure projects in Hyderabad and Mumbai.

Such innovations ensure that Asia’s creative economy remains globally competitive even as margins tighten.

Cultural consequences: the homogenisation debate

With streaming platforms serving pan-regional audiences, there is growing concern about homogenisation, the fear that local stories may be diluted to fit global templates. Yet evidence suggests the opposite.

Data shows that the most-watched shows across Asia in 2025 are deeply rooted in their local ethos: a Malay family drama in Kuala Lumpur, a Tamil-language crime series from Chennai, and a Korean romantic thriller set in Busan. What connects them is not sameness but universal emotion framed through distinct cultural lenses.

This localisation-within-globalisation model is precisely what keeps Asian entertainment vibrant. Far from erasing identity, streaming may be the tool that amplifies it to global ears.

Sports and live programming: television’s last fortress

One segment still holding television’s line is live sport. Cricket in India, football in Southeast Asia, and e-sports in Korea remain appointment viewing. Broadcasters rely on these rights to keep cable subscriptions alive.

However, even this domain is being encroached upon. Hybrid models are emerging in which major tournaments stream concurrently with traditional broadcasts, supported by interactive features such as multi-angle viewing and real-time statistics. As technology improves, streaming could claim even this bastion of live engagement.

The consumer’s power

At the heart of this transformation lies the empowered consumer. The audience no longer waits for scheduled programmes; it curates its own playlist of life. Every click is a vote that shapes the market.

This empowerment has ripple effects on employment and training. The demand for digital-ready production professionals, sound designers, data analysts, digital marketers, has risen sharply. Across Asia, universities and private academies are introducing specialised courses in OTT management and content analytics.

The creative economy is thus spawning a parallel education economy, preparing the next generation for jobs that did not exist a decade ago.

What it means for investors

For investors, Asia’s content industry represents both promise and paradox. On one hand, high engagement levels guarantee long-term relevance; on the other, thin profit margins and platform churn require patience.

Private-equity funds are beginning to take selective positions in post-production houses, dubbing studios, and technology startups that service the streaming ecosystem. These ancillary businesses offer steadier returns than headline platforms, which remain vulnerable to subscription volatility.

India’s entertainment sector alone is projected to touch ₹2.8 trillion by 2028, growing at 10–12 percent annually, with digital contributing the largest incremental share.

WFY viewpoint: towards a balanced entertainment economy

The current churn in Asia’s media landscape should not be seen as decline but as re-composition. Television still matters for rural connectivity and older audiences; cinema continues to symbolise communal celebration; streaming delivers personal choice and global reach.

The task ahead for policymakers and industry leaders is to ensure balance. Investment incentives for regional storytelling, transparent content-rating systems, and fair revenue-sharing between platforms and creators will determine the sustainability of this new order.

Equally crucial is digital inclusion. As streaming becomes the dominant medium, affordable internet access must remain a public priority, preventing cultural participation from becoming a privilege of the few.

The next act

Asia’s entertainment economy is at a crossroads. The numbers in the latest report are not just financial statistics, they are signposts of cultural evolution. The screen has multiplied, but so has opportunity.

By 2030, the boundary between television, cinema, and streaming will likely dissolve altogether. Content will move seamlessly across formats, and audiences will consume it through devices yet to be invented.

For India and its vast diaspora, this transformation carries immense potential. The stories once confined within national borders are now global assets, resonating in homes from London to Lusaka.

Television may fade, but storytelling never will. The medium changes; the message endures. And as Asia’s creative industries embrace this new chapter, the world is listening, on demand, in high definition, and in multiple languages.