Warning: The US Now Targets Russia With Sanctions

World Politics | By Sunita Krishnan– September 2025 Edition

Strong Warnings on Russia: The US Pushes Europe to Act

A New Phase in Washington’s Strategy

The United States has once again raised the stakes in its approach to Russia. Treasury Secretary Scott Bessent has indicated that Washington is prepared to adopt firm new measures aimed at reducing Moscow’s financial lifelines. But this readiness comes with a clear condition: Europe must fully align itself with American efforts if such measures are to be effective.

This fresh push comes against the backdrop of one of the heaviest aerial assaults launched by Russia against Ukraine since the start of the conflict in 2022. The scale of the attack has reinforced Washington’s belief that business-as-usual economic pressure is insufficient to change the Kremlin’s calculus.

Talks in Washington

High-level discussions took place in Washington between US officials and a visiting European Union delegation led by David O’Sullivan, the bloc’s sanctions envoy. The purpose was to strengthen coordination on sanctions and explore ways to close loopholes that Moscow has exploited to soften the impact of earlier rounds of restrictions.

Reports suggest that Monday’s session lasted under two hours, but it touched on key issues: extending secondary sanctions, imposing fresh tariffs, and broadening the range of Russian companies under scrutiny. Senior representatives from the Treasury Department, the White House, the State Department, and the US Trade Representative’s office were involved.

Bessent’s language after the meeting was unusually blunt. He stressed that “all options remain on the table” and underlined the need for Europe’s total partnership if stronger measures are to succeed.

Trump’s Parallel Pressure

President Donald Trump has made clear that he sees economic leverage as the sharpest tool to influence Russia. He has threatened more penalties against nations that continue to purchase Russian oil. India has already experienced this pressure in the form of targeted secondary sanctions, although larger economies such as China and the EU have so far avoided direct penalties despite their continued purchases of Russian energy.

Trump’s emphasis on oil revenues highlights a central aim of US policy: to cut off the funding streams that sustain Russia’s war machine. Yet this goal has proven difficult. Russia has rerouted much of its energy exports to Asia, particularly China, which has shown no willingness to reduce imports.

Europe’s Role and Reluctance

For Washington, European unity is critical. The EU has already imposed 18 rounds of sanctions since the invasion of Ukraine, targeting banks, defence firms, oligarchs, and energy projects. The 19th package is being finalised, with Germany and France reportedly pushing to include the oil major Lukoil.

But divisions remain. Some European governments worry that further restrictions could harm their own industries or provoke retaliation from Moscow, particularly in the energy sector. At the same time, eastern members of the EU and Baltic states argue for a harder line, pressing for wider use of secondary sanctions to punish third countries that help Russia circumvent existing measures.

The Challenge of Secondary Sanctions

Secondary sanctions remain a contentious issue. These measures penalise not only Russian entities but also third-country companies and governments that facilitate Russian trade. For the United States, this is a powerful way to isolate Moscow globally. For the EU, however, it risks diplomatic fallout with partners such as Turkey, India, and Gulf nations.

Nevertheless, the American argument is gaining ground. Officials in Washington insist that without closing these gaps, sanctions will remain porous and Russia will continue to finance its war effort.

The Ukraine Context

The war in Ukraine continues to be the central test of Western resolve. More than three years after Moscow’s invasion, the frontlines remain volatile. Russia’s recent aerial assault — one of the most intense since 2022 — has heightened fears of a prolonged conflict without resolution.

Ukraine’s economy has shrunk dramatically, its infrastructure battered by repeated strikes. International financial assistance has kept the state afloat, but Kyiv continues to plead for more weapons, more funds, and a stronger united stance against Russia’s backers.

US–EU Coordination: Possibility and Pitfalls

The Washington meetings are part of a wider attempt to rebuild trust and common purpose between the US and EU, which has sometimes been strained under Trump’s leadership.

While both sides agree on the importance of supporting Ukraine, differences over tactics — especially on secondary sanctions and the scope of trade restrictions — have created friction.

Still, the symbolic message of alignment remains important. By appearing together, US and EU officials signal to Moscow that the West is not fractured and that escalation will be met with collective responses.

Global Ripples

The impact of new sanctions will not stop at Europe’s borders. Countries across Asia, Africa, and the Middle East are watching closely, particularly those that have expanded trade with Russia over the past two years. From discounted oil deals to increased exports of consumer goods, many economies have profited from Russia’s isolation in the West.

If Washington and Brussels truly expand secondary sanctions, these countries could face hard choices: continue dealing with Russia and risk being cut off from Western markets, or scale back ties with Moscow at the expense of cheap energy and lucrative contracts.

A Question of Credibility

For Trump’s administration, credibility is on the line. Previous US threats have sometimes lacked follow-through, fuelling perceptions that Washington oscillates between tough rhetoric and pragmatic compromise. Bessent’s message of “strong measures” will need to be backed by actual policy actions to carry weight in Moscow and beyond.

Europe too faces a test. If divisions over sanctions deepen, Moscow may once again exploit cracks within the EU to weaken the overall impact of Western measures.

US–EU Sanctions Strategy: A New Test for Russia’s War Economy

Setting the Scene

The war in Ukraine, now well into its third year, has moved beyond the battlefield and into the economic trenches. In Washington and Brussels, officials are recalibrating sanctions, tariffs, and restrictions with the aim of tightening pressure on Russia. The latest signals from the US Treasury Department, led by Scott Bessent, highlight a willingness to escalate economic action—but only if Europe stands firmly alongside.

This evolving strategy exposes the fragility of Russia’s war economy and the risks for countries navigating secondary sanctions. To understand the scale, one must trace the sanctions timeline, Russia’s strained finances, Ukraine’s dependence on external aid, and the immense daily cost of war.

A Sanctions Timeline That Keeps Expanding

Since Russia’s invasion in February 2022, sanctions have multiplied. The European Union alone has introduced 18 successive packages, each aimed at closing loopholes.

Sanctions Timeline Snapshot

- 16th package (Feb 2025): Legal clampdowns and bans on dual-use goods.

- 17th package (May 2025): Expanded restrictions on industrial equipment.

- 18th package (July 2025): Targeted over 26 entities and cracked down on the so-called “shadow fleet” of tankers carrying Russian oil outside regulated markets.

This steady tightening illustrates how sanctions have become a marathon rather than a sprint, with Western governments adapting measures to Russia’s evasive tactics.

A timeline of the European Union’s latest sanction waves on Russia. Packages 16, 17, and 18 show a steady tightening—ranging from industrial restrictions to action against the “shadow fleet” moving Russian oil.

Russia’s Shrinking War Economy

Behind the bravado, Russia’s economy shows signs of severe strain. Growth has slowed sharply, inflation remains high, and the government has burned through much of its reserves to finance war.

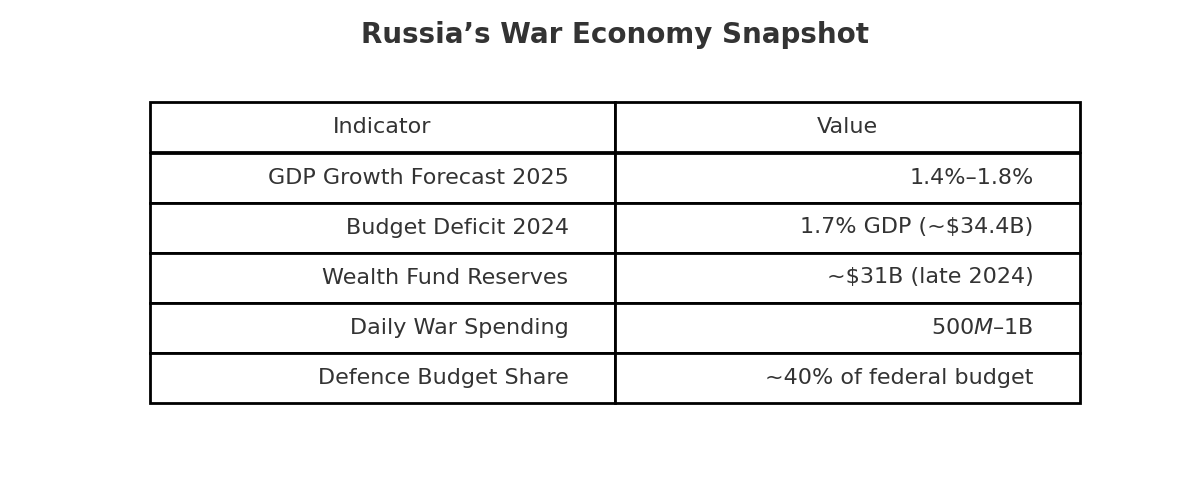

Russia’s War Economy Indicators

| Metric | Value |

| GDP Growth Forecast (2025) | 1.4%–1.8% (near stagnation) |

| Budget Deficit (2024) | 1.7% of GDP (~ $34.4B) |

| National Wealth Fund Reserves | ~$31B by late 2024 (down sharply) |

| Estimated Daily War Spending | $500M–$1B |

| Defence Spending Allocation | ~40% of federal budget |

Key indicators of Russia’s war-driven economy in 2024–25. Daily spending has soared to as much as $1 billion, while reserves and growth are under visible strain.

Russia’s so-called “Fortress Economy” is no longer impregnable. Defence spending now dominates the budget, crowding out investment in health, infrastructure, and civilian needs. The national wealth fund, once a cushion, has been eroded to levels that raise questions about long-term sustainability.

Ukraine’s Financial Strain

If Russia is struggling to finance its war machine, Ukraine is stretched to survive. Kyiv has poured extraordinary resources into defence while relying heavily on international assistance.

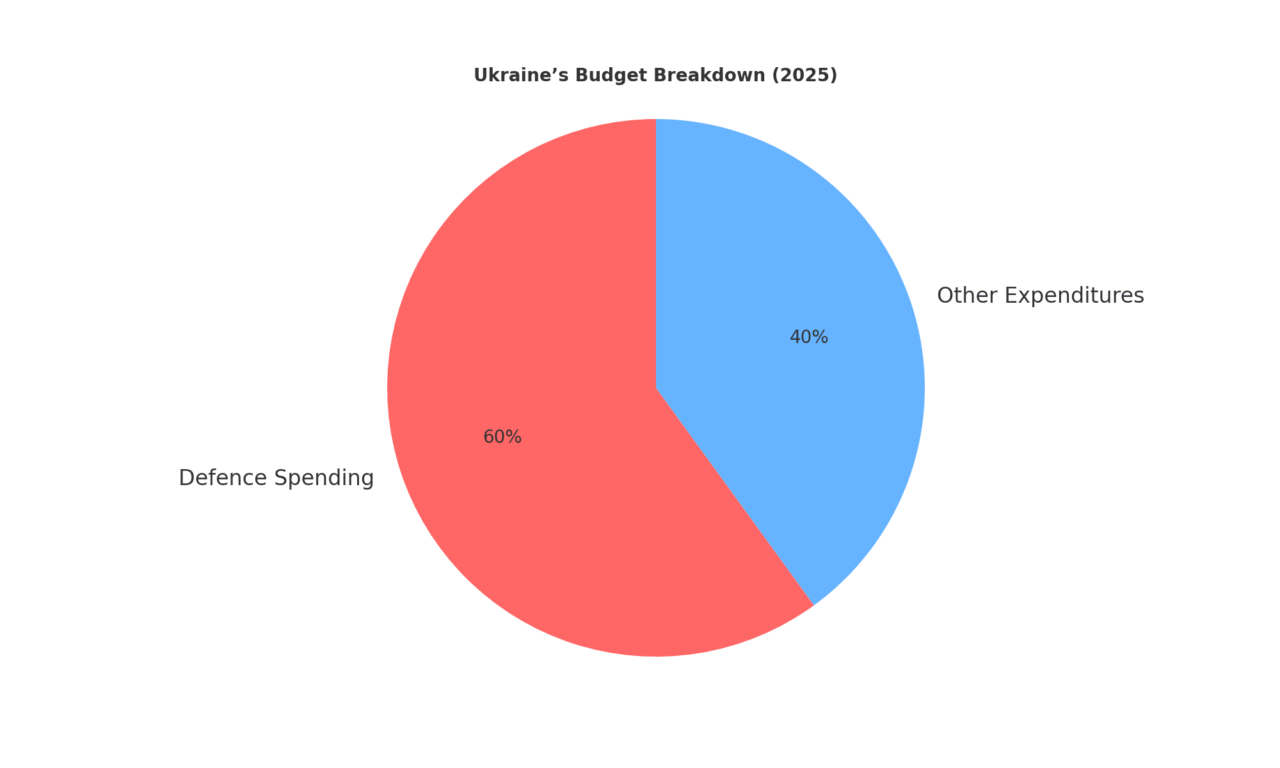

Ukraine’s Budget Breakdown

- 60% of the national budget is channelled into military spending.

- The rest covers pensions, public sector salaries, and humanitarian needs.

Ukraine’s national budget in 2025 shows defence dominating, with 60% allocated to military expenditure, leaving just 40% for all other sectors combined.

In September 2025, Ukraine formally requested a new IMF programme to secure financial stability. Without such backing, its government would be unable to cover even basic expenses.

The Daily Cost of War

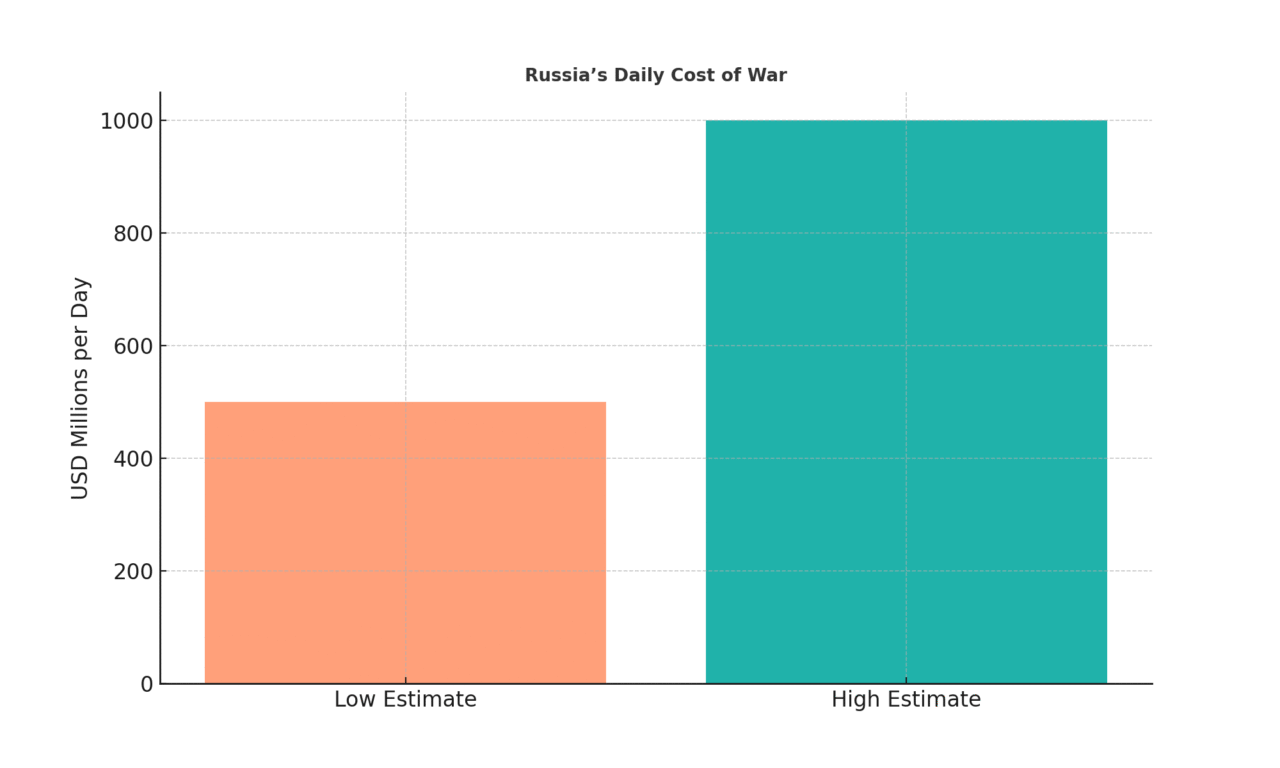

Numbers tell the starkest story.

Estimates suggest Russia spends between $500 million and $1 billion every day on the Ukraine war—a staggering burden that translates to over $360 billion annually.

The Financial Burn Rate

Russia is estimated to spend $500 million to $1 billion each day sustaining its war effort. That translates into $360 billion annually if the conflict continues at current intensity.

This daily drain is not just a fiscal challenge but also a strategic gamble. As Western sanctions restrict access to revenue and technology, sustaining such outlays risks pushing the Russian economy into deeper stagflation.

Strategic Implications for the West

For Washington, the challenge lies in keeping Europe aligned. The United States can threaten secondary sanctions and flex financial power, but without European enforcement, the impact is diluted. Countries like Germany and France, pressing to target firms such as Lukoil, show momentum is building—but divisions remain.

The paradox is that sanctions work best when universal, yet the global economy is fragmented. India and China, for example, continue to buy Russian oil, and their scale makes enforcement complicated. This reality underscores why the US is urging Europe to go beyond words and embrace “all options.”

A Volatile Road Ahead

Even as Trump’s administration pushes for stronger sanctions, scepticism remains over whether such measures can break Moscow’s resolve. Sanctions rarely deliver quick results; instead, they slowly choke economies, betting on cumulative impact.

The danger is twofold: if sanctions are too porous, Russia adapts and survives; if too severe, they may fracture Western unity. Either outcome could prolong instability in Europe’s east.

The Economics of War and Peace

The Ukraine conflict has become a contest not only of soldiers but also of treasuries. Russia is burning billions, Ukraine is surviving on aid, and the West is trying to calibrate economic warfare without losing its cohesion.

The sanctions timeline, Russia’s shrinking reserves, Ukraine’s budget dependency, and the sheer daily cost of war reveal a sobering truth: this is not just a military standoff, but an economic war of attrition.

For India and the global diaspora, the lesson is clear—geopolitics today is no longer fought only on the battlefield but in the balance sheets of nations.

Looking Ahead

The immediate future will likely bring another EU sanctions package and renewed debate in Washington about secondary measures. But the bigger question is whether these economic tools can truly alter Russia’s strategic behaviour. History shows that sanctions rarely force quick policy reversals. They work slowly, applying pressure over time, and often need to be paired with diplomatic and military strategies.

For now, Washington and Brussels appear committed to sustaining pressure. Whether this will be enough to shift the balance in Ukraine remains uncertain.

© The WFY Magazine | Sunita Krishnan |

Disclaimer: This article is an independent editorial analysis for The WFY Magazine. It draws upon publicly available information, international reports, and verified statistics. It does not claim to represent official positions of any government or institution.